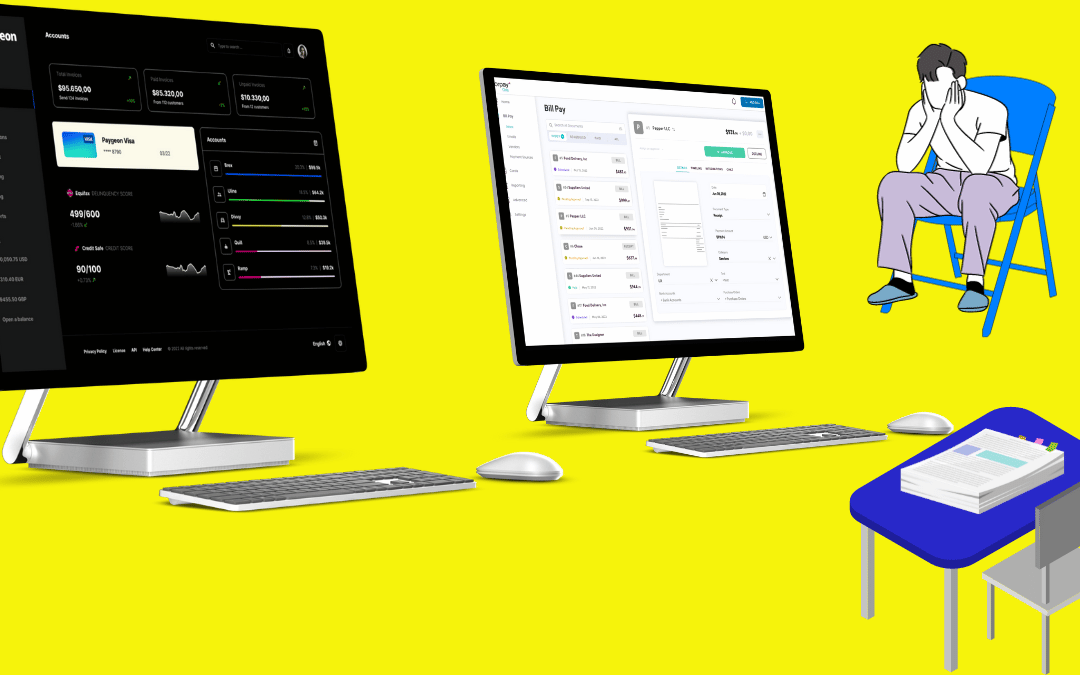

Automation tools in finance and business management have become indispensable for streamlining processes and improving efficiency. Two popular options in this space are Paygeon and Corpay One. In this article, we will provide an in-depth comparison of these two platforms, focusing on various aspects such as user-friendliness, payment automation, expense tracking, cost, customer support, security, integration, and scalability. By the end of this comparison, you should understand which platform might be the right fit for your business.

User-Friendliness and Ease of Onboarding

Paygeon: Paygeon prides itself on its user-friendly interface and streamlined onboarding process. The platform offers an automated workflow setup, making it easy for users to configure and use the software efficiently. Even those with limited technical expertise can quickly adapt to Paygeon.

Corpay One: Corpay One, on the other hand, follows a more traditional workflow setup, which can be less intuitive for some users. Setting up the system requires more time and effort, particularly for those unfamiliar with this type of software.

Verdict: Paygeon offers a more user-friendly experience with its automated workflow setup, making it a preferable option for businesses looking for a quick and easy onboarding process.

Payment Automation and Integration

Paygeon: Paygeon excels in payment automation. It offers a seamless payment processing system that can significantly reduce manual data entry and the risk of errors. The platform also integrates smoothly with popular accounting software, ensuring that your financial data is always up to date.

Corpay One: While Corpay One also provides payment automation capabilities, its customization of automation rules can be more complex. Users may need to invest more time configuring these rules to suit their needs.

Verdict: Paygeon stands out with its user-friendly and efficient system if payment automation is a top priority.

Expense Tracking and Reporting

Paygeon: Paygeon offers robust expense tracking capabilities. Users can easily categorize expenses, attach receipts, and generate detailed expense reports. The reporting features are comprehensive and can provide valuable insights into your spending patterns.

Corpay One: Corpay One provides solid expense tracking and reporting functionalities. Users can categorize expenses and create detailed reports to gain insights into their financial activities. While it may not be as feature-rich as Paygeon, it still meets the needs of many businesses.

Verdict: Paygeon shines regarding expense tracking and reporting, offering a more comprehensive solution for businesses seeking detailed financial insights.

Cost and Pricing

Paygeon: Paygeon typically follows a straightforward pricing model, often based on the number of users and transactions. This simplicity makes it a cost-effective choice for many small to medium-sized businesses.

Corpay One: Corpay One’s pricing structure can be more complex. Costs may vary depending on the specific features and integrations your business requires. It’s essential to carefully evaluate the pricing options to determine the best fit for your budget.

Verdict: Paygeon’s straightforward pricing model is often favored for its transparency and affordability, especially for smaller businesses.

Customer Support and Service

Paygeon: Paygeon places a strong emphasis on customer support. They typically offer responsive customer service, including live chat, email support, and extensive documentation to assist users.

Corpay One: Corpay One also provides customer support, but the quality and responsiveness may vary. Users have reported mixed experiences with their support services.

Verdict: Paygeon has a more consistent track record of providing reliable customer support.

Security and Compliance

Paygeon: Paygeon places a high priority on security and compliance. The platform often employs advanced encryption methods to protect sensitive financial data and ensure industry standards and regulations compliance.

Corpay One: Corpay One also emphasizes security and compliance but may have varying security features depending on the chosen plan.

Verdict: Both Paygeon and Corpay One take security and compliance seriously. However, Paygeon’s consistent focus on these aspects may make it a preferred choice for businesses with stringent security requirements.

Integration and Scalability

Paygeon: Paygeon is known for its seamless integration with various accounting software and other business tools, enhancing its scalability for growing businesses.

Corpay One: Corpay One also offers integration options but may require more customization to meet the specific needs of a growing business.

Verdict: Paygeon’s robust integration capabilities make it a scalable solution suitable for businesses of all sizes.

The Verdict: Paygeon or Corpay One?

The choice between Paygeon and Corpay One depends on your specific business needs and priorities. Paygeon may be the preferred choice for businesses seeking a straightforward and intuitive solution, primarily if they heavily rely on integrations with accounting software. Corpay One may be more appealing to companies that require a high degree of customization and are willing to invest time in the initial setup.

Ultimately, both platforms have their strengths, but we found Paygeon to be the more user-friendly and beneficial software for businesses looking for a quick and efficient way to streamline payment automation, expense tracking, and financial reporting. It offers compelling user-friendliness, affordability, and robust features that many businesses will find highly advantageous.